The Evaluation System for Immovable Security Rights

Aims of the Evaluation System

The Round Table on Security Rights over Immovable Property began to develop a system for evaluating security regimes covered by the Database vdpmortgage. It is based on the answers given to the questions in chapters I–VI. Evaluation of the answers facilitates comparison of the quality of legal systems. This allows the development of insights for scholarly examination, case law and statutory development. The information is used internally by vdp Expertise and the vdp. All credit claims held by credit institutions must be supported by capital. The capital requirement is less if the relevant claim is secured with a right over immovable property. Where statistics are available which reflect the success of enforcement of securities in a given country in the past, they can form the basis of credit risk assessment and thus determination of capital requirements. However, for many countries, there is insufficient historical data for such an analysis. In such cases, the evaluation system can assist in assessing the probability of default of immovably secured debts with reference to the concrete position in a given legal system.

Together with participants in the LGD-Grading Pool Project, vdp Expertise has developed the LGD (Loss-Given-Default) National Scaling Factors on the basis, inter alia, of the material in the Database vdpmortgage. These LGD National Scaling Factors facilitate the determination of the basic parameters of the loss which is to be expected in the case of default of a loan secured by a cross-border immovable security right.

More information on the LGD-Grading Pool Project for residential and commercial immovables.

Operation of the Evaluation System

Assessment of the quality of a rule will depend on the perspective from which the assessment is undertaken. From the lender’s point of view, it might be best for enforcement to be as quick and efficient as possible. A consumer or the owner of commercial property is likely to consider it more important to protect against enforcement which is too fast or even unjustified and to allow scope for the exercise of every possible legal mechanism by which loss of ownership might be prevented. For this reason, all questions and answers are weighted from four perspectives:

- Creditor/Exercise (Enforcement of the Immovable Security Right)

This perspective considers how a legal rule facilitates expeditious exercise of immovable security rights and receipt of the proceeds which correspond to that right’s ranking. - Creditor/Use (Flexible use of immovable security rights)

This perspective evaluates the extent to which it is possible to use an immovable security right flexibly for different claims and situations. This can save considerable amounts of time and money for both the creditor and the owner and facilitate development of new financing concepts. - Ownership (Protection)

This perspective is almost diametrically opposed to Creditor/Exercise. The owner has no interest in rapid enforcement. Rather, the owner’s interest is protection of their rights and in the opportunity to assert them in the context of enforcement and insolvency proceedings. Evaluations for rules concerning the reliability of the register and flexibility in the application of immovable security rights are more closely aligned. - Legislator

This perspective evaluates whether a given legal solution strikes an appropriate balance between the interests of the parties. The legislator must not favour one party above all the others. In addition, he must also take into account the interests of the subordinated secured and unsecured creditors in a satisfaction from the debtor’s assets (which also include the immovable property). Thus, the legislator must consider the interest of lower-ranking and unsecured creditors in satisfaction of their debts.

The significance of a given question is also evaluated. Of course, a question which is of limited significant from one perspective can be very important from another. The significance of each question is therefore assessed from each of the four perspectives..

This ensures that the weighting of questions is as consistent as possible. In this regard, it is important to avoid excessive weighting for areas where a large number of questions have been developed. Not all questions which are of scholarly interest have the same practical significance for the quality of immovable security rights. In lights of this, the following overall weighting has been established for chapters I–VI:

- Types of Security Rights Over Real Property: 1%

- Public Disclosure Requirements and Protection of Trust: 25%

- Effects of Accessoriness: 12 %.

- Enforcement: 25 %.

- Insolvency: 25 %.

- Praktische Anwendungsmöglichkeiten: 12 %.

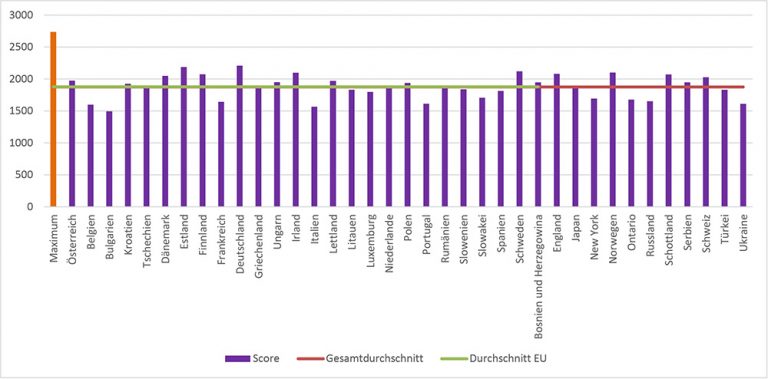

Finally, these evaluations allow the legal systems to be compared with one another. These are presented using bar charts.